Table of Content

The rented part of your home isn't a self-contained residential unit having separate sleeping, cooking, and toilet facilities. This isn’t a secured debt unless it is recorded or otherwise perfected under state law. For more detailed definitions of grandfathered debt and home acquisition debt.

Under the loan agreement, Sharon must make principal payments of $1,000 at the end of each month. During 2021, her principal payments on the second mortgage totaled $10,000. Show how much of the interest each of you paid, and give the name and address of the person who received the form. Deduct your share of the interest on Schedule A , line 8b, and print “See attached” next to the line. Also, deduct your share of any qualified mortgage insurance premiums on Schedule A , line 8d.

What Are Mortgage Points?

A licensed tax advisor can review your situation and let you know how to deduct mortgage interest – or if you should at all. Check your buying power by getting pre-qualified for a mortgage with us at Zillow Home Loans. Mortgage points, also known as discount points, are an option for buyers to pay an upfront fee at closing to buy down the interest rate on a loan. The term ”points” is a common way of referring to a percentage of your loan amount.

The same goes if you are taking out a loan and letting the money sit in the bank as your emergency fund. What’s more, the renovations have to be made on the property on which you are taking out the home equity loan. Always consult a tax professional before filing, but for some homeowners, the mortgage interest tax deduction can reduce their taxable income by thousands of dollars. Premiums paid for a home loan protection insurance plan are tax deductible under section 80C of the Income Tax Act, 1961 only if the borrower makes repayment. Under specific circumstances, where the lender finances such an insurance plan and the borrower repays via loan EMIs, deductions are not allowed. Any loans you have on a property shouldn’t exceed a total of $750,000.

Should I Get a Home Equity Line of Credit (HELOC) or a Home Equity Loan for the Tax Deduction?

Check with a tax professional if you're paying interest on a loan that falls into another category. Deductions—either itemized or adjustments to income—are not the same as tax credits. The property may let out the property during the financial year. The property was vacant for whole financial year or a part of the financial year. Owing to such vacancy the actual rent received or receivable by the owner is less than the amount specified in point . In such a case the actual amount of rental income received will be the gross annual value.

The OPI Service is a federally funded program and is available at Taxpayer Assistance Centers , other IRS offices, and every VITA/TCE return site. The Tax Withholding Estimator (IRS.gov/W4app) makes it easier for everyone to pay the correct amount of tax during the year. The tool is a convenient, online way to check and tailor your withholding.

How to Claim Mortgage Interest on Your Tax Return

(Learn more about Form 1098 here.) You may also be able to get year-to-date mortgage interest information from your lender’s monthly bank statements. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here's a list of our partners.

The insurance must be in connection with home acquisition debt, and the insurance contract must have been issued after 2006. In 2021, you took out a $100,000 home mortgage loan payable over 20 years. The terms of the loan are the same as for other 20-year loans offered in your area. You can deduct $60 [($4,800 ÷ 240 months) x 3 payments] in 2021. In 2022, if you make all twelve payments, you will be able to deduct $240 ($20 x 12).

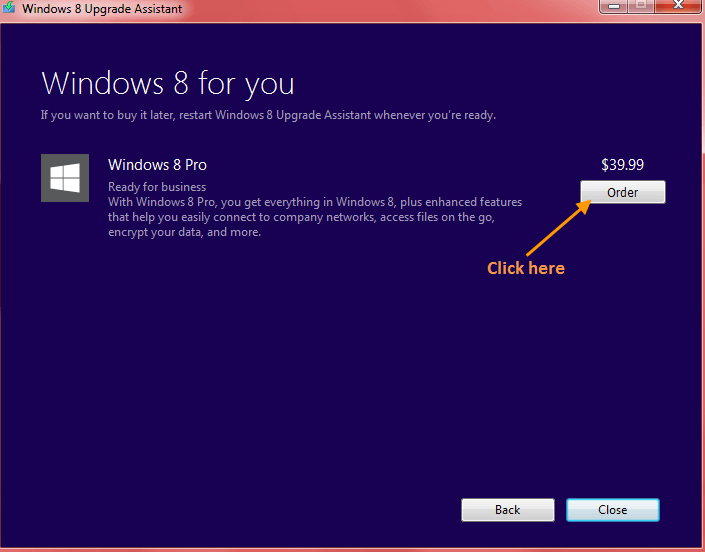

Best HELOC Lender for Competitive Rates in Ohio: PenFed

Choosing whether to buy discount points or not comes down to when you’ll reach your break-even point. The break-even point is calculated by dividing the cost of points by the monthly payment savings to show you how many months it will take you to make a profit. Lenders can help you calculate your break-even point and show you multiple loan options to help you make an informed decision. The table below shows you the cost per point and the interest rate reduction you’ll likely receive for each discount point you purchase. Each mortgage discount point will cost you 1% of the loan amount and cut your interest rate by 0.25%. On a $300,000 loan at 6.25%, one discount point would cost you $3,000 and lower your interest rate to a flat 6%.

However, you can't deduct the prepaid amount for January 2022 in 2021. (See Prepaid interest, earlier.) You will have to figure the interest that accrued for 2022 and subtract it from the amount in box 1. You will include the interest for January 2022 with other interest you pay for 2022.

Remember to keep records of your spending on home improvement projects in case you get audited. You may even need to go back and reconstruct your spending for second mortgages taken out in the years before the tax law was changed. You’ll have to choose a home and find the right loan type, but you’ll also decide how much money to put down and whether to lower your interest rate with mortgage points. If you have a home equity loan or line of credit and the funds were NOT used to buy, build, or substantially improve your home, then the interest cannot be deducted.

If you know of one of these broad issues, report it to them at IRS.gov/SAMS. TAS is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights.